Analysts from the cryptocurrency exchange Bitfinex hold an optimistic outlook for the cryptocurrency market in 2025. They indicate through multiple indicators that the market has not yet reached its peak, forecasting that Bitcoin will hit its high in the third to fourth quarter of next year, with price peaks potentially ranging between $145,000 and $189,000.

In a report released on Monday, Bitfinex stated that the current bull market reflects strong institutional demand, primarily driven by exchange-traded funds (ETFs) and spot accumulation. Historical data suggests, “we are in the mid-cycle,” and with the Bitcoin halving occurring in April 2024, the market may reach its peak around the third to fourth quarter of 2025, roughly 450 days post-halving.

The report also assesses the current market status and future trends based on various indicators. The analysts wrote:

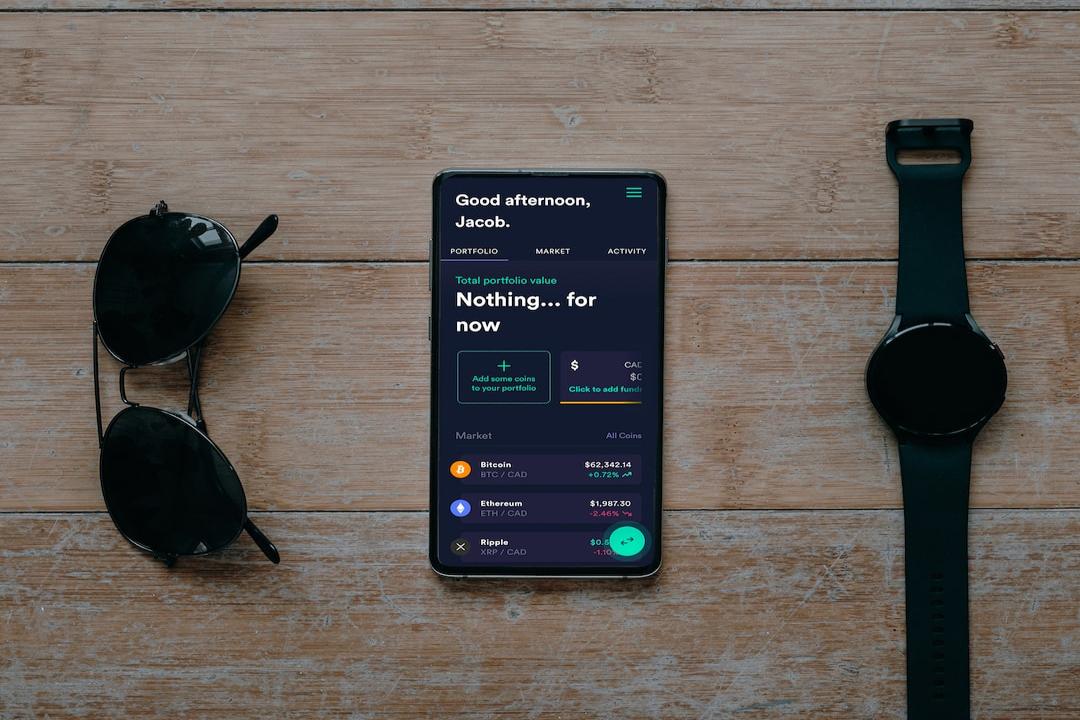

Pi Cycle Top Indicator (Source: Bitfinex)

According to CoinGlass, the Pi Cycle Top Indicator can be used to signal when the market is overheating. Historically, when the short-term moving average (i.e., the 111-day moving average shown in the image above) rises and crosses above 350DMA x 2, Bitcoin prices are usually in an overheating phase.

Bitfinex analysts believe that any price correction in 2025 will be relatively mild, thanks to the influx of institutional funds. Moreover, based on past historical cycles, the year following a halving typically experiences the strongest price increases. Analysts also estimate that Bitcoin will reach a cyclical target price of at least $145,000 by mid-2025, “potentially extending to $200,000 under favorable conditions.”

However, the report indicates that Bitcoin may exhibit volatility in the first quarter of 2025 and advises investors to be vigilant for signs of overbought conditions as Bitcoin approaches the cycle peak.

Successful Conclusion of CoinEx Taiwan’s 7th Anniversary Celebration, Embracing the Arrival of the Web3 Era Hand in Hand with Users

Since its establishment in 2017, CoinEx has been a professional cryptocurrency trading pla…